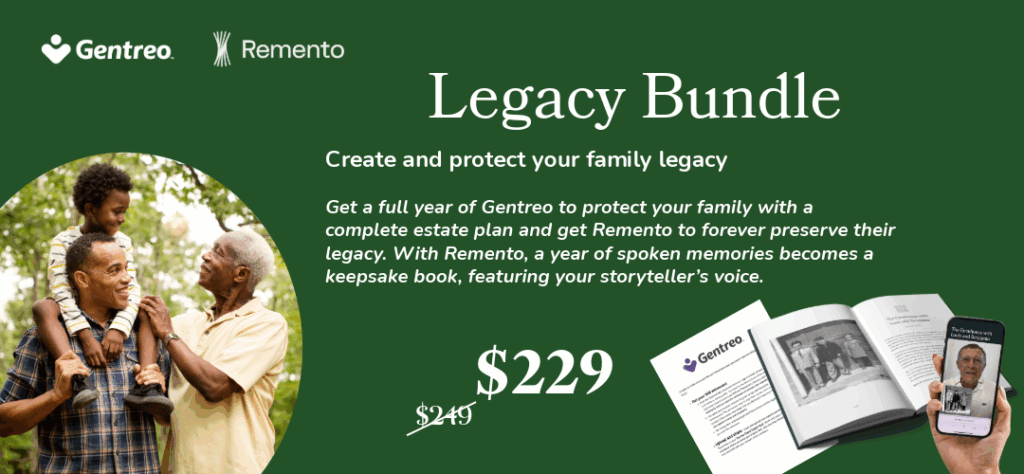

Express your wishes. Protect your loved ones. Eliminate uncertainty.

Digital Estate Planning Tools to Protect Your Family

Create your personalized estate plan with all the essential documents—Will, Living Trust, Power of Attorney, and more—for one simple annual price. With Gentreo, you can create, update, and securely store everything you need to protect your family. Plus, get powerful tools like our Digital Vault, unlimited updates, and Life Milestones™ to help you stay prepared through every stage of life. Our platform is one of the most trusted online estate planning services, designed for families who want affordable, simple, and secure solutions.

Gentreo - The Life Milestone Company

Make sure you don’t leave a giant mess behind for your loved ones. Estate planning doesn’t just happen after you die; it’s a lifelong process, and Gentreo is with you every step of the way. With our easy-to-use online platform, you can create a last will, living trust, and other key estate planning documents without expensive fees. Whether you’re considering LegalZoom, Rocket Lawyer, or Quicken WillMaker, it’s important to understand the pros and cons of each provider. Gentreo stands out by offering a complete plan at one low cost, making it a trusted choice for families nationwide.

Gentreo’s step-by-step tools walk you through the estate planning process, help you organize your assets, and guide you in naming beneficiaries clearly and securely. By helping to reduce the confusion that can come with probate, probate court and the probate process, you can spare your loved ones unnecessary stress.

Everything's For Only $150!?!

How's That Possible?

At Gentreo, we believe estate planning should be accessible and affordable for every family. While many companies charge $150 for just a will or hundreds more for a trust, Gentreo includes your complete estate plan—Will, Trust, Power of Attorney, Health Care Proxy, and more—for only $150 your first year, then just $50 annually after that.

How can we offer so much for so little?

Simple: Our legal team built state-specific, legally binding documents that you can complete yourself through our easy, guided surveys. No hidden fees, no legal jargon—just the tools you need to protect what (and who) you love.

More value. Less cost. All legal.

That’s Gentreo.

Benefits of Estate Planning

Gentreo is the personalized, next-generation estate planning solution that brings together everything you need to create and manage your estate plan. Our online platform allows you to manage everything securely.

Peace of Mind

Create, update, and securely store all of your estate planning documents in one place. Everyone knows where to turn.

Peace of Mind

Know your estate, living trust, and last will are legally valid.

Protect Your Dependents

Nominate legal guardians to care for your minor children and other dependents, including pets.

Protect Your Dependents

Ensure your children, spouse, and other loved ones are safe.

Protect Your Choices

Make choices about what you want to happen if you become incapacitated or pass away, and keep your documents current with unlimited updates.

Protect Your Choices

From HIPAA authorization to health care proxies, we help you keep control.

Keep Your Plan Up-to-Date

Stay informed on state and federal laws, so you can keep more of what’s yours. Amend your plan when life changes.

Keep Your Plan

Up-to-Date

Life changes, so your plan should too.

Prepare Your Family

Provide clarity and direction so your loved ones know your wishes and aren’t forced to go through expensive legal battles. Ease their grief with a complete plan.

Prepare Your Family

Clear estate planning documents reduce the chances of disputes in the court probate process.

Our extensive library has all kinds of information and checklists so you can learn about estate planning.

What's Included?

Everything you need in one place, when you need it most. Control who has bank-encrypted, secure access to your information, documents, and choices.

Gentreo is a full-service digital estate planning solution and has been cited for excellence by U.S. News & World Report, AARP and Kiplinger.

Gentreo means "Three Generations" – we're here to help you protect your children, yourself, and your aging parents with estate planning.

Gentreo is a member of the Massachusetts Caregiver coalition. This innovative team of leading employers, advocates, and government partners are committed to recognizing, supporting, and building creative solutions that allow family caregivers to continue to thrive in the workplace while also caring for family at home.

I was able to plan my future and my family’s future easily and at a fraction of the cost.

Mike F.

I love my dogs more than anything. With Gentreo, they are now taken care of today and tomorrow.

Mary C.

Gentreo is peace of mind! My mother constantly loses her legal documents. Now, we have Gentreo and the Family Vault. I can now leave the state (literally!).

Kate B.

My mom died and I paid thousands to settle her estate because she thought she didn’t need a will. I won’t do that to my kids.

Tammy B.

FAQs

How much does estate planning cost?

With Gentreo, you can create a complete estate plan, including last will, living trust, power of attorney, and more, for only $150 your first year, then $50 annually. This includes unlimited updates. No hidden fees.

What is estate planning?

Estate planning is the process of preparing legal documents to protect your assets, name trusted decision-makers, and outline how your affairs will be managed both after your death and if you become unable to represent yourself. An estate plan can include a last will, living trust, certificate of trust, HIPAA authorization, power of attorney, and other essential documents that help ensure your wishes are carried out according to your intentions.

Who needs estate planning?

Anyone with assets, minor children, or pets should consider estate planning. Even if you own a modest estate, a living trust or last will ensures your family is protected and your assets are distributed according to your wishes, not state law.

What documents are needed for estate planning?

A comprehensive plan typically includes a last will, and a health care power of attorney which can include HIPAA authorization, and other estate planning documents like a living trust and power of attorney. Gentreo provides everything you need in one platform, plus options for funeral planning and digital asset management.

How to start estate planning?

Start online with Gentreo’s guided surveys. You can create your living trust, last will, and other estate planning documents entirely online. Everything is included.

What happens if my estate goes through the probate process?

If you have a valid last will, your estate will still go through probate, but the process is often greatly simplified and much faster because your wishes are clearly documented. Note that after you pass away, because of probate, your will becomes public record, which means anyone can view it and see how your assets are distributed.

If you don’t have a will or living trust, you are considered to have died intestate, meaning the court decides how to distribute your property according to state law. This can cause delays, added expenses, and unnecessary stress for your loved ones.

Creating a living trust through Gentreo’s online estate planning tools can help your estate bypass probate entirely, keeping your affairs private and ensuring that your assets are transferred directly to your chosen beneficiaries. With Gentreo, you can easily create a will, living trust, and other essential estate planning documents to protect your family, simplify the legal process, and give everyone peace of mind knowing your wishes are secure and accessible.