The death of a loved one is an extremely difficult thing to experience. Although most of us will go through the grief that comes from this loss, few of us are prepared to handle all of the logistics, especially if your loved one did not have important documents such as a Will or Trust.

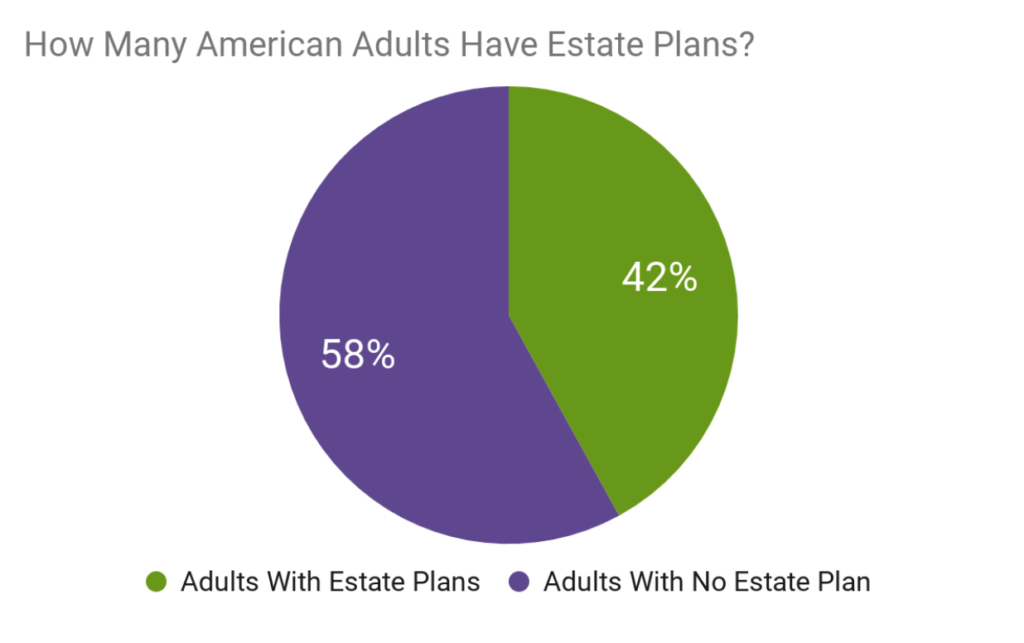

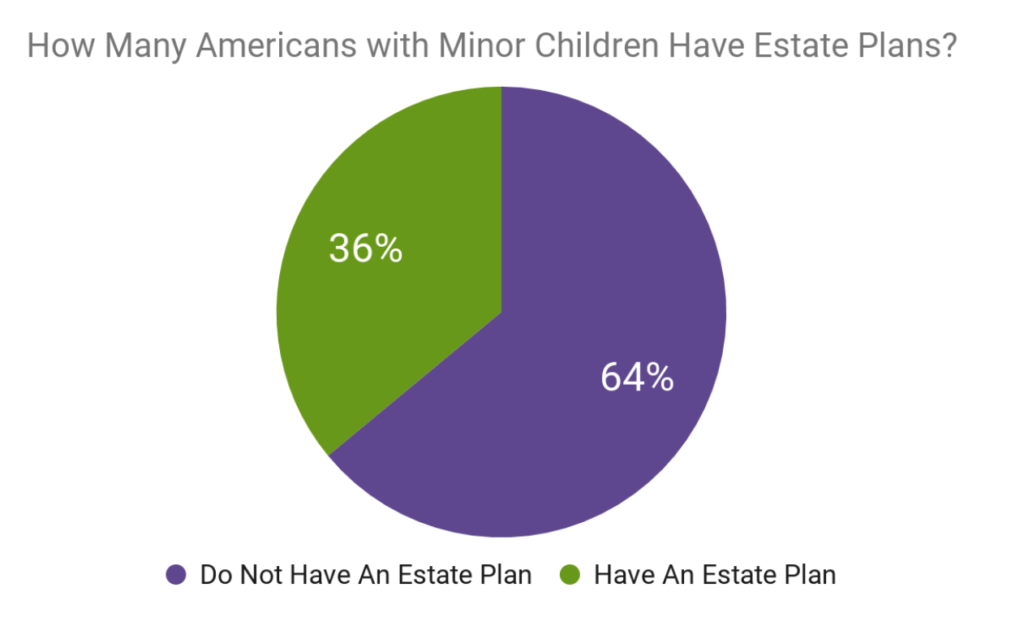

This is especially concerning, since less than half of Americans have these documents. According to a survey by Caring.com, “only 42 percent of U.S. adults currently have estate planning documents such as a Will or Living Trust. For those with children under the age of 18, the figure is even lower, with just 36 percent having an end-of-life plan in place.”

Don’t wait until it’s too late; start your estate planning journey with Gentreo today. By doing so, you’ll not only protect your loved ones but also gain the peace of mind that comes with knowing your legacy is secure. Click here to join now https://private.gentreo.com/auth/register.

This article is for informational purposes only and should not be considered legal advice. Consult with a qualified attorney or estate planning professional for personalized guidance.

Since a Will or Trust are the only documents that allow a parent to legally assign a guardian for their minor children, these statistics are very alarming. For those 64 percent of parents with minor children who don’t have these documents, the courts would decide who would care for their children if they became incapacitated or passed away.

Whether you’re an elderly grandfather of twelve putting your affairs in order in case you pass away, or a young mom with two kids, it’s important to have a Will. Any person 18 years of age and older should also have documents like a Health Care Proxy and Power of Attorney to protect your wishes while you’re alive.

However, we’ll get into those documents and how a death of a loved one affects their power and function later in this guide.

Quick Links:

- What to Expect When Someone Passes Away

- How to Cope with the Loss of a Loved One

- Legal and Logistical Steps After Death

- Checklist of Things to Do Right After Someone Dies

- How to Deliver News That Someone Has Died

- Checklist of Things to Do Within Two Weeks of Someone’s Death

- What Happens to a Will When Someone Dies

- Common Services to Cancel When a Loved One Dies

What to Expect When Someone Passes Away

Not everyone dies in the presence of others, and sadly, it’s even less common for someone to pass away surrounded by their loved ones. However, if they do, it can be difficult for their surviving loved ones to know what to do, especially if they passed away at home and without healthcare professionals to direct what’s next.

Whether your loved one passes away in a facility (such as a hospital, nursing home, or assisted living) or at home, nothing needs to be done immediately. Everyone should do what they wish to grieve; some may want to stay with their deceased loved one, while others may want to leave the room.

How long can loved ones stay with the body?

The length of time you and your family can stay with your deceased loved one depends on where the death happens. Hospitals, nursing homes and other facilities may have limitations on how long you can occupy the room and stay with your loved one, but they may also be flexible if your family has religious, cultural or ethnic customs. The key is to discuss these customs with the facility’s staff early on, before your loved one passes, so that they can best work with you to ensure you have appropriate time for your rituals. Of course, if the death happens at home, you will have more control over the timing of events.

What should loved ones do while waiting for the caretaker?

After a loved one dies, surviving family members may not be sure how to act or what to do. You shouldn’t force anyone to do anything they’re uncomfortable with, but you can offer suggestions. Some may want to sit quietly with the deceased, while others may not want to be in the room at all. While some might have a lot of emotions, others may be numb and dazed by the passing of their loved one. You may want to comfort or console one another, share memories about the deceased, or hold a small ceremony with the support of a spiritual counselor or religious leader. Lastly, you or another family member may want to notify any family members or friends who are not present that the deceased has passed. Later on in this guide, we’ll provide tips about how to have these conversations.

What about rigor mortis?

One thing to expect after the deceased has passed is rigor mortis, the stiffening of the joints and muscles of a body after death. It begins to set in within a few hours of the person’s passing, so you may want to consider positioning your loved one’s body so that it is lying flat.

How to Cope with the Loss of a Loved One

- Joining a bereavement or support group

- Talking to a mental health professional (therapist or psychiatrist)

- Surrounding oneself with family and friends

Legal and Logistical Steps After Death

When someone dies, there are a lot of personal, financial and legal details to take care of. If they did not have a Will, the situation becomes even more complicated, since the laws of your state determine how the deceased estate will be handled. You or other family members would have to go to court in order to do things like paying your loved one’s bills or selling their car. If they died with minor children, the courts would also decide who would become their guardian, which could be very concerning in cases where the other parent is deceased or has a bad relationship with the deceased’s other family members.

If your loved one has a Will when they die, there is still a lot of work to do, but the pressure and complexity is significantly less. In these cases, the deceased’s Will would include how they want their assets distributed, who would care for their minor children, and who would act as their personal representative and executor of their estate.

This person would be responsible for most of the legal and logistical steps to take when someone dies. It’s a big job, as well as bureaucratic and stressful. Not only that, but the whole process can take a year or more from start to finish, and often the executor is a close family member of the deceased and therefore is grieving their loss while handling all of these logistics.

It’s a lot, and if your deceased loved one named you executor of their estate, you shouldn’t try to do it alone. Throughout the process, you should consult with professionals like CPAs and attorneys as well as asking for help from family and friends.

Checklist of Things to Do Right After Someone Dies

After the initial moments following your loved one’s passing, there are a few things the family members should do:

Get an official declaration of death

If your loved one died at home or anywhere other than a facility like a hospital or nursing home, you will need to get a legal pronouncement of death from a medical professional. This document is the first step toward getting a death certificate, which you will need for other steps later in the process. To get a declaration of death when someone dies at home, call 911 as soon as you’re ready to have the body taken away. The EMTs will take your loved one to the hospital to officially declare them dead, and then move them to the funeral home they chose in their funeral plan.

Notify friends and family

One difficult task that loved ones must do when someone has died is to let the deceased person’s other family and friends know that they have passed. You might make individual phone calls, send out a mass email or group text, or a combination. For example, you may call the person’s close friends and immediate family, and send an email to everyone else. You may need to use your deceased loved one’s phone or email to find contact information. Don’t forget to notify people such as the person’s coworkers, church, and any other social groups they were a part of, and ask them to inform others that may have known them. Additionally, you could put a post on your deceased loved one’s social media profiles to notify any others, but before you do so, you should ask yourself whether the deceased person would want their passing announced on social media. And, if you do decide to post, follow these steps:

- Pay tribute to the accomplishments, character, and positive qualities of the deceased, including any time they spent in the military or public service (if applicable).

- Note the day, time and location of their funeral service or memorial.

- Do not go into detail about how the person passed away.

- Mention whom they are survived by (spouse, children, grandchildren, etc.).

How to Deliver News That

Someone Has Died

- Share the news in person, if possible. None of us want to receive bad news, but if we do, it can be easier to take if the person telling you does so in person. When you’re face-to-face, things like tone, body language, and facial expressions can help to convey the message in a more sympathetic, comforting manner. Of course, in-person conversations will not always be possible, such as if the person lives in another state. However, with tools like FaceTime or Zoom, you can share the sad tidings in the next-best way.

- Avoid using the words “died” or “dead”. Your primary objective with these conversations is to let a person’s loved ones know that they have died, but it’s still very important to take their feelings into account and attempt to reduce their emotional distress upon hearing the news. Words like “dead” and “died” are not very tactful, and may be harder for the person to process or accept. Instead, use phrases like “no longer with us”, “passed away”, or “moved on”.

- Keep the news short and simple. The news that a loved one has died can be overwhelming on its own, so you should try to share it simply. Don’t go into all of the details yet, and keep the news brief and straightforward, telling the person that their loved one has passed and a short explanation of why or how.

- Be prepared to answer questions. As they receive the news of their loved one’s passing, some people may have lots of questions, specifically about how the person died. You don’t need to have all of the answers, but you may want to be prepared to field them.

- Give them time and space. We all react differently to grief and loss. After you tell someone that their loved one has passed away, they may need some time and space to themselves. While your first instinct may be to hug them, don’t assume that they want physical comfort and ask before invading their personal space.

Find caregivers for minor children and pets

If your loved one passes away and leaves behind minor children or pets, you will need to find immediate and long term caregivers. If they had a Will, your loved one probably assigned a guardian for their child, but if they did not have a Will, you will need to make temporary arrangements until the courts finalize the guardianship. This is why it’s so important for people to have a Will; without one, the courts make decisions about how your assets are distributed and who cares for your children after you die. Pets are sometimes also provided for in a person’s Will, or in a more pet-specific Make sure pets have caretakers until there's a permanent plan for them. Send them to stay with a relative who likes animals or board them at a kennel.

Gather any existing funeral plans and make funerary, burial or cremation arrangements

Hopefully, you had a conversation with your loved one about what they wanted their funeral or memorial to be like, and whether they wanted to be buried or cremated. Some people go even further, and pre-plan and pay for their funeral before they die. However, for those that did not discuss their wishes with their loved ones or create a plan, their surviving family members can be unsure of how to proceed. First, look for any documentation, such as a letter of instruction, that outlines the deceased person’s wishes. If you’re unable to find any, call a family meeting to discuss everyone’s desires for the funeral, and what the family can afford. You will need to select a funeral home and talk about specifics like how and where the service will be held, whether or not your loved one will be cremated, and how their remains will be handled. Ahead of this meeting, you should do research to find the typical costs of different funerary services or options.

Q&A

Who has the right to make funeral arrangements?

The people the deceased named in their Will as their executors (or, if the deceased didn’t make a Will, their nearest relatives) are primarily responsible for arranging their funeral.

Ask for help

Dealing with the death of a loved one is never easy, especially if you’re the executor of their estate. You will probably need help in a variety of ways, so ask for it. If the deceased was a veteran or member of fraternal or religious groups, contact the Veterans Administration or the other organizations to ask if they offer burial benefits or conduct funeral services. Ask friends and relatives to handle different parts of the funeral, such as writing an obituary or giving a eulogy, acting as pallbearers, writing thank-you notes or arranging parts of the service.

Secure the deceased's property

In the days following the death, it’s important that you or someone you trust does what they can to protect the person’s property and valuables from would-be burglars as well as sticky-fingered relatives. Make sure the deceased person’s home, vehicle and any other assets are locked. Ask a friend or neighbor to water the plants and get the mail, so that the property doesn’t look like it’s abandoned in the weeks following the death of your loved one. Of course, if they lived with someone else, you can most likely skip this step.

Forward their mail

Save yourself the time and hassle of visiting your loved one’s home every few days to pick up the mail. USPS offers a convenient mail forward online, but you can also visit your local post office and put in a forwarding order. Not only does forwarding mail reduce hassle for you, it keeps mail from piling up at your loved one’s home, indicating its vacancy. Additionally, you’ll want to go through the mail to determine which bills, subscriptions, and other accounts need to be cancelled or paid.

Notify your loved one’s employer (if applicable)

If your loved one was still working when they passed away, you should notify their employer of their passing as soon as possible. You should ask about any paychecks that may be due and request any information available about benefits, such as life insurance policies that were offered through the company.

Checklist of Things to Do Within Two Weeks of Someone’s Death

After family members have accomplished the immediate tasks after their loved one has died, there are a number of other timely things to do to proceed with managing their estate and affairs:

Get 10 or more certified copies of their death certificate

Local authorities will issue a death certificate when someone passes away, and typically, the funeral home will be able to get copies for you, but you can also order copies from the vital statistics office. You should get about 10 copies, since you will need the certificate in order to close bank and investment accounts, claim life insurance benefits and social security survivor benefits, transfer titles, and more.

Locate the Will and identify the executor

A key part of dealing with your loved one’s estate is their Will, assuming they created one. If they died without a Will, it’s known as intestate and the laws of the state in which they passed away would determine how their estate is distributed and by whom. If your deceased loved one created a Will, the first step is to find it. Ideally, they stored it digitally in something like the Gentreo Digital Family Vault so that you can access it even if you’re out of state. In other cases, your loved one may have stored their Will in a safe deposit box at the bank or in a fire safe in their home. If that’s the case, it may be more difficult for you to access the document, especially if you don’t have authorization to access their safe deposit box or you cannot access their home. Once you access the Will, the executor (the person who will manage the settling of the estate) named in it will need to be contacted because they will need to be involved in most of the steps going forward.

What Happens to a Will

When Someone Dies

-

-

- Locate the Will – Determine if your loved one had a Will. If they didn’t have this document, settling their estate is going to get pretty complicated, and you may need to hire an attorney to help.

- Validate the Will – If your loved one had a Will, it needs to be validated in court, a process known as probate. Usually the person who probates the Will is the person who was nominated to serve as personal representative or executor of the estate.

- Appoint the Personal Representative – Depending upon your state, anyone can petition the court to become administrator of a decedent’s estate. However, if multiple people petition the court for that role, the court usually gives preference to relatives per the laws of intestacy in the state. Again, this is why it is important to have a Will, so you can nominate your choices to serve as personal representative of your estate.

- Begin Settling the Estate – Once the Will has been probated and the personal representative (also known as the executor) has been appointed, they can begin gathering the assets and paying debts and finally making distributions to the beneficiaries pursuant to the terms of the Will. The personal representative should have the deceased’s mail redirected to them so that the personal representative can begin the due diligence of uncovering all the assets. This process is made easier if the decedent was organized and stored all important documents in a secure but accessible location such as the Gentreo Digital Family Vault.

- Gather Assets – The process of gathering assets can be complex and arduous. You will need to ascertain what assets if any the decedent owned and compile an inventory of them. This includes everything from personal property like kitchen supplies and furniture to bank accounts; real estate; automobiles; investment accounts. The personal representative needs to inform any financial institution where the decedent had assets about his/her appointment. All assets are then usually transferred into an estate account with the personal representative responsible for that account. For real estate, unless the Will includes a power to sell, you need court authority to sell. If the Will includes the authority, then the personal representative can proceed without court approval. If no one wants any of the personal items or there is no specific bequest in the Will, the personal representative sells those items and then adds the cash to the estate account. Usually those items do not have a high value. This “step” is a large one in and of itself because what action the personal representative takes in regards to the asset depends upon the asset. Further, unless the decedent was organized and shared all his/her information, the Personal Representative is almost like a detective in trying to uncover all the assets. This is why at gentreo.com, we offer the Digital Family Vault and Team sharing feature. It enables you to organize and list your assets/debts in a secure but accessible location. Furthermore, it is easy to edit as your assets change.

- Pay Debts – The easiest way to ascertain debts is by accessing the decedent’s mail and /or reviewing bank accounts for electronic funds transfers to pay bills. Most people/agencies who are owed money send regular statements in the mail detailing the amount owed. Certain bills should be cancelled right away like health insurance but others, such as those related to property may need to continue, like keeping the heat/lights on so the home can be inspected and sold. The Personal Representative must account for all of their actions so it is important to document what bills are paid. You should always pay in a way that there is a record, like a check.

- Distribute Bequeaths – After the assets are inventoried and debts are paid, the personal representative can make the gifts and distributions to beneficiaries as outlined in the deceased’s Will.

-

Consider hiring an attorney if the estate is extensive

You don’t necessarily need an attorney to settle an estate, but having one will certainly make things easier, especially if your loved one had a lot of assets. Consider hiring an estate lawyer if your loved one’s estate is worth a lot, since you may need help navigating the process and distributing a greater number of assets. Estates can get complicated quickly, and expert guidance may be crucial.

Contact a CPA to prepare your loved one’s final tax return

Your loved one may already have had a CPA and if so, you should contact them about filing their final tax return. If your loved one previously prepared their own taxes, you might want to consider hiring a CPA because the final tax return may be more complicated. It’s important that taxes are filed correctly.

Take the Will to probate

Probate is the legal process of validating and executing a Will, and appointing the personal representative or executor. You'll need to do this at a county or city probate court office. Probate court makes sure that the person's debts and liabilities are paid and that the remaining assets are transferred to the beneficiaries.

Inventory all of your loved one's assets

As part of the probate process, you may need to make an inventory of all of your deceased loved one’s assets – their real estate, bank accounts, car, personal property, furniture, jewelry, etc.). It can be a challenge to track down all of your loved one’s assets in order to inventory them. You may need to comb through their tax returns, mail, email, brokerage and bank accounts, deeds and titles, and other places in order to find assets. Once the inventory is complete, you will need to file it with the court. You may also need to hire an appraiser to determine the value of some items.

List all bills and debts, cancel services

By reviewing your loved one’s bank statements and bills that come in their mail, you will need to catalogue a list of all bills and debts. If you are not the executor of your loved one’s estate, you should share this list with the appointed person so that important expenses such as the mortgage, taxes and utilities are paid while the estate is settled. You may also want to begin preparing a list of bills and services to cancel, such as your loved one’s mobile service, internet, cable, and any streaming services.

Q&A

Who’s responsible for your parent’s medical bills after they die?

In most cases, the deceased person’s estate is responsible for paying any debt left behind, including medical bills. However, if there’s not enough money in the estate, family members are usually not responsible for covering a loved one’s medical debt after death — although there are some exceptions.

Common Services to Cancel

When a Loved One Dies

Here is a list of common services that people have, which you may need to cancel on your loved one’s behalf when they pass away. We’ve included helpful links to direct you about how to cancel these accounts. In most cases, you’ll need copies of the death certificate to cancel your loved one’s accounts.

<a style="color: #ffffff;"Apple Mail

<a style="color: #ffffff;"Gmail

<a style="color: #ffffff;"Hotmail

<a style="color: #ffffff;"Yahoo Mail

Internet

<a style="color: #ffffff;"Xfinity/Comcast

<a style="color: #ffffff;"Spectrum

<a style="color: #ffffff;"CenturyLink

Cable TV

<a style="color: #ffffff;"Xfinity/Comcast

<a style="color: #ffffff;"DirecTV

<a style="color: #ffffff;"AT&T U-verse

Cancelling Your Loved One's Social Media Accounts

You can delete your deceased loved one’s Facebook or Instagram accounts, but you may want to turn these accounts into a memorial for your loved one instead. In Facebook’s case, this change adds the word “Remembering” in front of the deceased’s name, and friends will still be able to post on the timeline. Whether you choose to delete or memorialize your loved one’s social media accounts, you’ll need a copy of your ID as well as the death certificate.

Notify appropriate officials & organizations of the death

In addition to informing family members and friends that your loved one has passed, there are a few government organizations and other institutions that need to be notified:

- Social Security Administration – If someone who is receiving Social Security benefits passes away, their death must be notified to the Social Security Administration to stop benefit checks. Typically, the funeral director will handle this step, but they may not, and it is ultimately the survivors’ responsibility to ensure this is done. Contact the local Social Security Administration office in your deceased loved one’s town of residence, and they will inform Medicaid if applicable.

- Department of Motor Vehicles – Contact the Department of Motor Vehicles for their state and cancel their driver’s license. Doing so will remove them from the DMV’s records and prevents identity theft. You will need a copy of their death certificate, and their local DMV may have specific instructions for you to follow.

- Banks & Financial Institutions – You will need to get access to your loved one’s bank and other financial accounts, and provide them with a copy of the death certificate in order to close the accounts. For credit cards, contact the creditor’s customer service and inform them that you’re closing the account on behalf of a deceased relative. Keep records of all accounts you close, and inform the executor of any outstanding balances on the cards, since these will need to be paid by the estate.

Q&A

How long do you need to keep bank statements after a death?

Keep the deceased’s financial documents for at least three years following their death, or three years after any necessary estate taxes are filed (whichever is sooner).

- Insurance Provider – To make claims on any life insurance policies the deceased had, you will need policy numbers and a copy of the death certificate for the benefit to be released. Inform any other insurance providers (home, auto, health, etc.) of your loved one’s death, and end coverage for now unnecessary policies. You may be able to get a refund for any unused premiums.

- Stockbrokers & Financial Advisors – If your loved one had any investment accounts, stocks or bonds, you should contact their financial advisor or broker to close the account and distribute the assets to the beneficiaries your loved one chose in their Will. Beneficiaries may need to simply fill out a few forms and provide a copy of the death certificate to access the asset, depending on the type.

- Credit Agencies – It’s important to protect your loved one’s identity, even though they have passed. Report their death to all three major firms (Equifax, Experian and TransUnion) and send copies of the death certificate to prevent identity theft and further complications to the settling of the estate.

Conclusion

When a loved one passes away, it can be challenging for their surviving family and friends in many ways. If you were named as their executor and personal representative of their estate in their Will, there are many things to do and it can be a full-time job to settle their estate, especially if they did not prepare and store their records in a convenient, digital location. We hope this comprehensive guide will help you navigate the process of settling your loved one’s estate and reinforces your own estate planning, so that you can prevent similar stress and work for your loved ones if you should pass away.

Don’t wait until it’s too late; start your estate planning journey with Gentreo today. By doing so, you’ll not only protect your loved ones but also gain the peace of mind that comes with knowing your legacy is secure. Click here to join now https://private.gentreo.com/auth/register.

This article is for informational purposes only and should not be considered legal advice. Consult with a qualified attorney or estate planning professional for personalized guidance.